Thursday 25th March saw NASDAL (National Association of Specialist Dental Accountants and Lawyers) hold its annual press conference – this year virtually at BDIA Dental Showcase – and many Principals, Associates and team members, along with the dental media, joined what was an enlightening event with 5 presentations and then an interactive Question & Answer session.

It has been an unusual twelve months and this year’s event reflected this by being billed as a ‘State of the Nation’ press conference dealing as it did with a wide variety of dental related financial and legal matters.

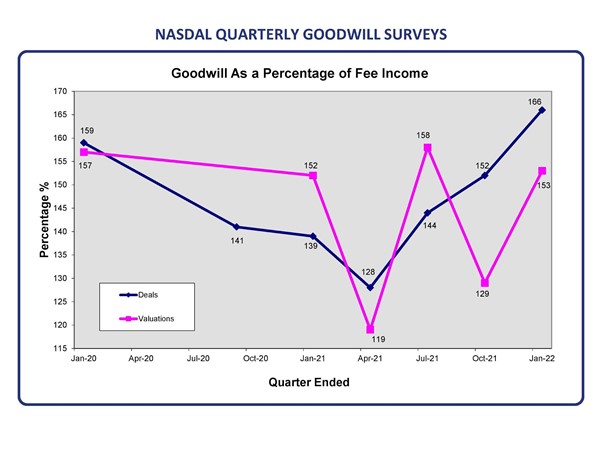

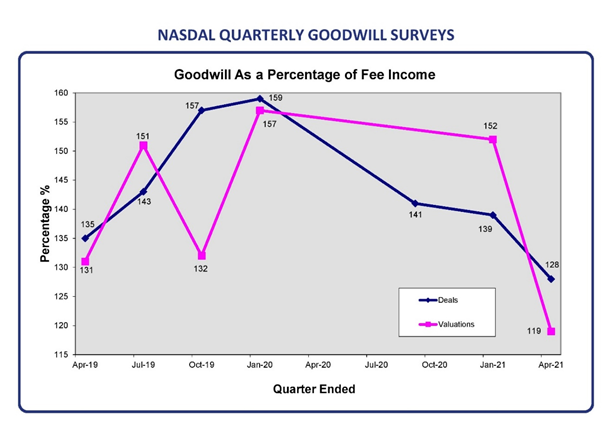

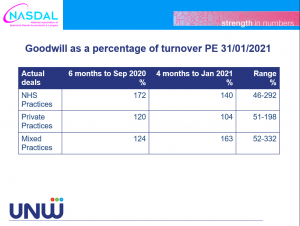

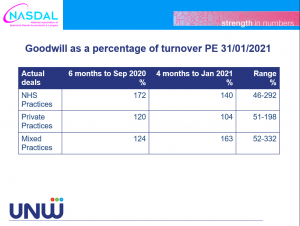

After being welcomed by Nick Ledingham, Chartered Accountant and Senior Partner of Morris & Co, Specialist Dental Accountants and Chairman of NASDAL, the conference heard the latest goodwill value statistics announced by Alan Suggett, specialist dental accountant at UNW and NASDAL Media Officer. These are normally produced on a quarterly basis but due to the pandemic, the latest figures covered the four months that ended 31st January 2021.

Against what many may have expected, the latest period showed very little reduction in practice values due to the pandemic. As with the last survey (which covered the period from 1st April to 30th September 2020), in NASDAL members’ experience, although there have been only limited price reductions, there has been a considerable lengthening of the sales process. Alan commented, “It certainly does show that the UK dental practice sales market is not the dystopian nightmare that some commentators have suggested!”

Benchmarking Statistics – “continued fall in NHS practice profits but better news for Associates”

Ian Simpson, Chartered Accountant and a partner in Humphrey and Co, then presented the Benchmarking Statistics for the year 2019-2020. The NASDAL benchmarking statistics are published annually in March and reflect the finances of dental practices and dentists for the most recent tax year. The NASDAL figures provide a detailed picture of dental practice finances, sourced directly from dentists working privately and in the NHS. They are immensely useful but this year, as the period in question only ran until March 2020, they have limited information to offer about the effect of the pandemic. However, they do make interesting reading. Some of the key points from this year were:

- A continued fall in NHS practice profits – this is perhaps as NHS practices tend to depend more on the use of Associates

- A slight fall in net profit across the market as a whole

- Better news for Associates with an increase in fee income of 3% and an increase in net profit of 2%

- Practice expense ratios stayed very consistent with previous years

Ian Simpson said, “Overall, we have seen results similar to the previous year with a small impact of COVID-19 in Feb/Mar 2020. Net profit of a typical dental practice fell back to £129,178 from £134,387 in 2019 and both NHS and Private practices saw a reduction in profit (NHS – £116,284 in 19/20 down from £124,475 in 18/19; Private – £133,192 in 19/20 down from £140,591 in 18/19). Only mixed practices bucked this trend with a small rise from £132,940 in 18/19 to £134,342.

“What the figures will show for the year of the pandemic is conjecture at this point, but we certainly find ourselves in a very different landscape now from a little over a year ago.”

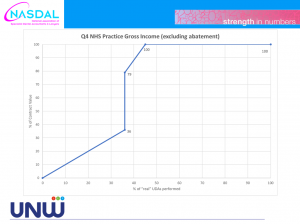

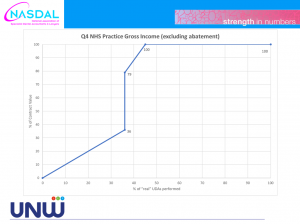

NHS Quarter 4 – meeting the targets

Alan Suggett then returned to discuss what has happened (in England), since the beginning of January 2020 in terms of Q4 targets and the need to achieve 45% of pre-pandemic activity to avoid any financial penalties by way of ‘clawback’. Alan identified two key issues that were affecting practices.

“First and foremost, my concern is for a small but significant number of practices that will be unable to hit the threshold of 45% of UDA contract amounts and how that ‘cliff edge’ will affect them. The fact that many NHS practices are already hitting this target is good news but irrelevant to those that cannot.”

“Another perhaps unconsidered consequence of the Q4 rules is pay cuts of more than 65% for some self-employed dental associates who carry out NHS work. During the COVID 19 crisis a very important measure of financial protection has been given to NHS associates as so far they have been paid in full. Q4 rules brought this to an end for those associates who work in practices which cannot hit the 45% UDA threshold.

“I feel that a fair compromise is quite simple – remove the ‘cliff edge’ at 36%. I worry that without this change, a small percentage of the total NHS contract holders could be in real trouble. In addition, the associates who work in those practices could suffer a pay cut in excess of 65%.”

“I will leave Heidi to discuss what might happen as of 1st April, suffice to say that there will be no material change in circumstance between 31st March and the following day and therefore I would be surprised to see any movement from the 45% figure.”

Practice sales market – “still buoyant”

Chair of the NASDAL Lawyers Group and partner at Ward Hadaway, Damien Charlton then discussed the Practice Sales market over the last year. As Alan Suggett had already referred to, this was a whole lot busier than many might have expected. What the pandemic did do was slow the entire sales

process. Damien said, “From March 2020 until June 2020 there was a hiatus as society was locked down. Then, volumes of practice sales picked up quickly and NASDAL members saw a particular surge earlier this year as many sought to avoid a potential Capital Gains Tax increase in the Budget that as it turned out, didn’t materialise.”

“To illustrate the added time now involved, it can take up to 20 weeks for the CQC to register a new partnership allocation! As we move forward, it seems that those buying practices are having to do so in more of a ‘blind’ fashion than in is traditional. Even though a practice has been successful in the past, the new world that we find ourselves in, means it is no guarantee of future prosperity.”

The Future – “the reckoning of the end of furlough”

The final presentation was delivered by Heidi Marshall, who is the NASDAL Honorary Secretary and heads up the dental team at Dodd & Co Chartered Accountants. Heidi had the unenviable task – even more so in these times – of considering what may happen in the coming months.

Heidi covered a wide range of areas including Q1 percentages, clawback and the ‘Zoom Boom’ of dentistry. She also shared evidence of mixed practices taking the decision to leave the NHS as they are finding that the numbers no longer add up.

Heidi particularly focused on the end of furlough and that September 2021 will see a real reckoning in many sectors. “I think that we will see the true impact of what the end of furlough will mean for our economy. Potentially hundreds of thousands of people could find themselves out of work and that will certainly mean a reduction in enquiries for elective dentistry but perhaps even the more regular dental care too?”

Nick Ledingham, of Morris & Co, Specialist Dental Accountants and Chairman of NASDAL concluded, “I am pleased to see that the UK dental sector has reacted to the challenge that Covid has provided in a typically robust fashion, but it has been a tough 12 months for many and the future is still uncertain.

“Now, more than ever, it is important that dental practices take specialist advice so that they can understand and react to changes in their business situation.”