Dental associates tax question could worry dental corporates

NewsPosted by: Dental Design 3rd August 2018

As told in Out-law.co.uk, earlier this week, HM Revenue & Customs (HMRC) had written to about 50 dentists as part of an inquiry into the employment status of ‘dental associates’ for tax purposes.

According to the British Dental Association, most dentists in general practice in the UK work as self-employed associates. The arrangement sees the associates pay practice owners for the right to use practice premises, equipment, materials and staff, it said.

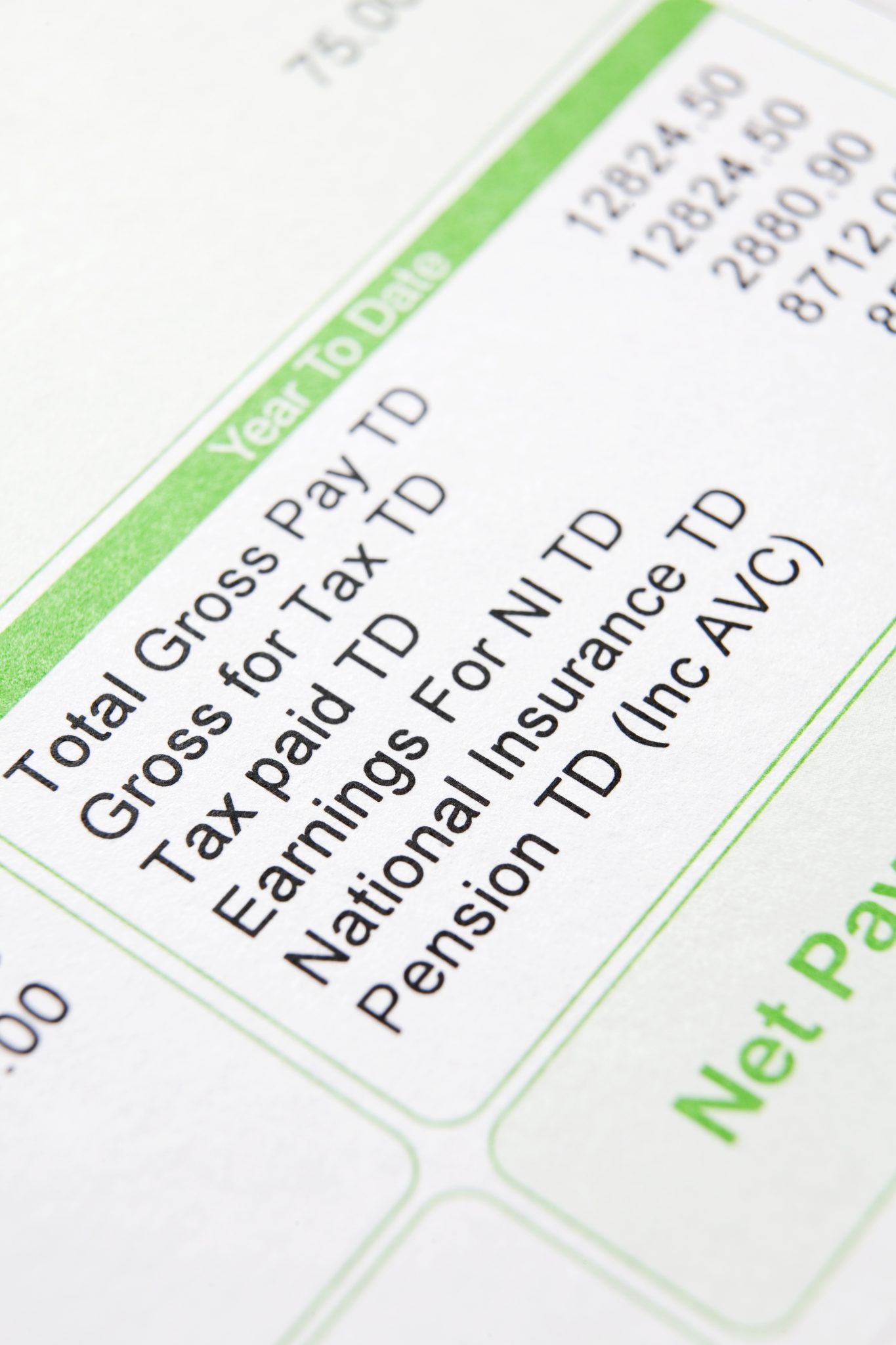

Under the self-employed model, dentist businesses do not pay employer NI contributions in respect of dental associates. If those associates were classed as employees for tax purposes, that tax position would changeEmployer NI is currently payable at 13.8 per cent.The financial implications for businesses in the dental sector would be significant if it is found that dental associates should not be treated as self-employed but as employees for tax purposes, said corporate law expert Joanne Ellis of Pinsent Masons, the law firm behind Out-Law.com.

It is clear that over the last 12 to 18 months the status of employees, self-employed persons and workers across all sectors has been facing a greater degree of scrutiny than ever before. It is now the dental sector’s turn to be under the spotlight, in particular the longstanding arrangements in place between a practice owner and associate.”

“Although, at this stage, HMRC is taking tentative steps, any such change to associates’ self-employed status would likely result in substantial financial implications to practice owners. The market is already experiencing difficulty finding good associates to fulfil UDA/UOA quotas and HMRC’s actions could see that challenge become even greater. This could impact on the delivery of NHS services. We will all be watching HMRC’s inquiry closely over the coming months,” she said.